An Unbiased View of Transaction Advisory Services

Transaction Advisory Services Fundamentals Explained

Table of ContentsSome Ideas on Transaction Advisory Services You Need To KnowGetting The Transaction Advisory Services To WorkHow Transaction Advisory Services can Save You Time, Stress, and Money.The Definitive Guide to Transaction Advisory Services4 Simple Techniques For Transaction Advisory Services

This step ensures the business looks its finest to potential buyers. Getting business's worth right is critical for a successful sale. Advisors make use of different techniques, like affordable money circulation (DCF) evaluation, comparing to comparable companies, and current deals, to determine the fair market value. This aids establish a reasonable price and work out properly with future purchasers.Purchase advisors step in to help by getting all the required details organized, answering questions from purchasers, and arranging visits to the service's location. Deal experts utilize their knowledge to help business proprietors take care of difficult arrangements, meet purchaser assumptions, and framework deals that match the proprietor's goals.

Satisfying lawful rules is vital in any company sale. Purchase advising services work with legal professionals to develop and review contracts, contracts, and various other lawful documents. This reduces risks and makes certain the sale complies with the regulation. The role of transaction consultants prolongs beyond the sale. They aid entrepreneur in preparing for their next steps, whether it's retirement, starting a new venture, or handling their newly found wide range.

Purchase experts bring a wide range of experience and expertise, making sure that every element of the sale is dealt with professionally. Through strategic preparation, evaluation, and arrangement, TAS aids entrepreneur accomplish the highest possible list price. By making certain lawful and governing conformity and managing due persistance along with other deal group participants, deal advisors decrease possible dangers and liabilities.

Some Ideas on Transaction Advisory Services You Should Know

By comparison, Big 4 TS teams: Job on (e.g., when a potential customer is carrying out due persistance, or when an offer is closing and the purchaser needs to incorporate the company and re-value the vendor's Balance Sheet). Are with fees that are not linked to the offer shutting efficiently. Gain charges per involvement somewhere in the, which is much less than what investment financial institutions earn also on "small offers" (yet the collection likelihood is also a lot greater).

The meeting concerns are really similar to financial investment banking meeting questions, yet they'll focus extra on bookkeeping and valuation and less on topics like LBO modeling. As an example, expect questions concerning what the Change in Capital means, EBIT vs. EBITDA vs. Earnings, and "accounting professional just" topics like test equilibriums and how to stroll via events utilizing debits and debts as opposed to monetary declaration changes.

Some Known Factual Statements About Transaction Advisory Services

that show just click here to read how both metrics have actually transformed based upon products, channels, and customers. to evaluate the precision of monitoring's previous forecasts., consisting of aging, stock by product, typical degrees, and stipulations. to figure out whether they're entirely fictional or somewhat believable. Experts in the TS/ FDD groups might also talk to monitoring concerning whatever over, and they'll compose a thorough record with their searchings for at the end of the process.

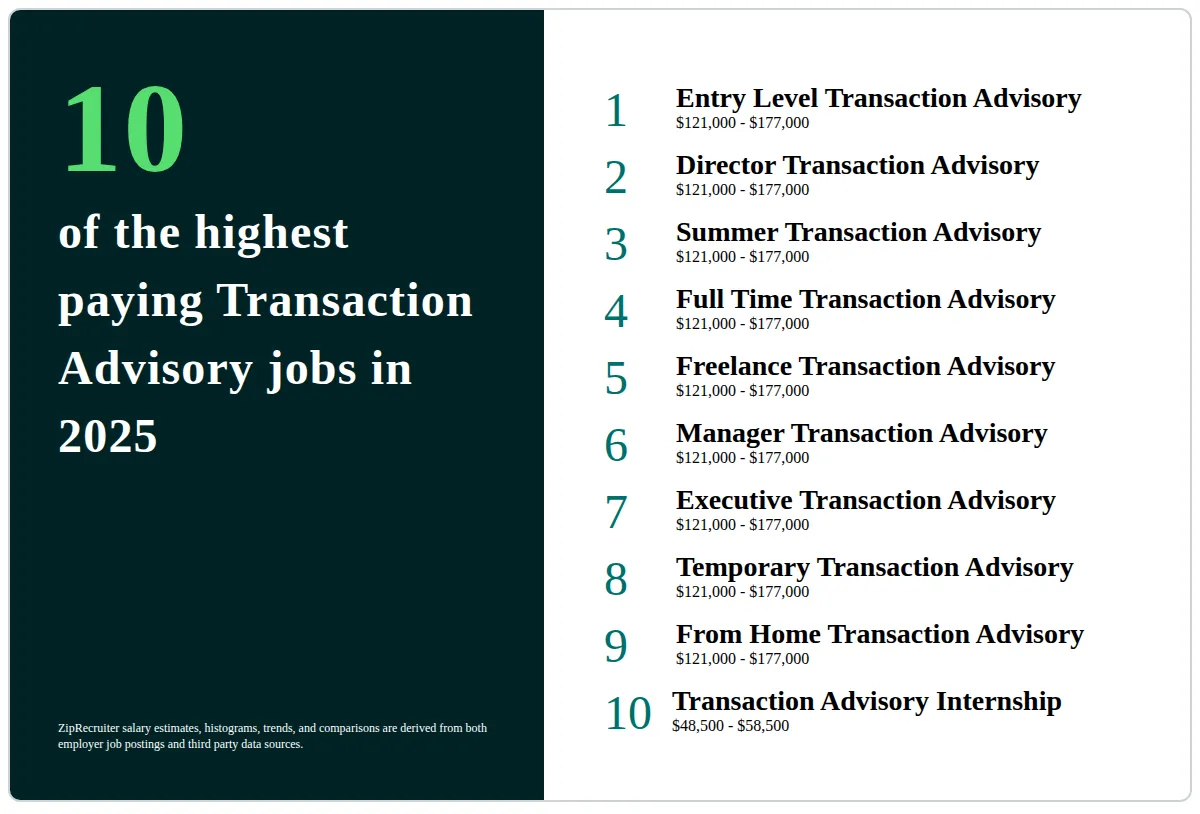

The hierarchy in Purchase Solutions differs a little bit from the ones in investment financial and exclusive equity professions, and the general shape appears like this: The entry-level function, where you do a great deal of information and financial evaluation (2 years for a promotion from here). The following level up; comparable work, yet you get the even more interesting little bits (3 years for a promotion).

In certain, it's difficult to obtain advertised beyond the Manager degree because few individuals leave the work at that stage, and you need to begin showing evidence of your capability to create income to breakthrough. Let's begin with the hours and way of living because those are less complicated to describe:. There are periodic late evenings and weekend work, yet nothing like the frenzied nature of financial investment financial.

There are cost-of-living changes, so anticipate reduced settlement if you're in a cheaper area outside major monetary (Transaction Advisory Services). For all settings except Partner, the base pay comprises the bulk of the total compensation; the year-end perk could be a max of 30% of your base pay. Typically, the most effective method to enhance your profits is to switch over to a various company and bargain for a greater income and benefit

About Transaction Advisory Services

You might get involved in corporate growth, however financial investment financial obtains a lot more tough at this phase since you'll be over-qualified for Analyst roles. Business financing is still an alternative. At this phase, you need to simply remain and make a run for a Partner-level duty. If you intend to leave, possibly transfer to a client and execute their evaluations and due persistance in-house.

The main issue is that due to the fact that: You generally require to join an additional Big 4 group, such as audit, and job there Resources for a few years and after that relocate into TS, work there for a couple of years and afterwards move into IB. And there's still no warranty of winning this IB role since it relies on your area, clients, and the employing market at the time.

Longer-term, there is likewise some threat of and because examining a firm's historical financial info is not precisely rocket scientific research. Yes, humans will always need to be included, yet with advanced innovation, lower head counts might possibly sustain client engagements. That said, the Deal Solutions team defeats audit in regards to pay, job, and leave opportunities.

If you liked this short article, you may be curious article about analysis.

Transaction Advisory Services Can Be Fun For Everyone

Develop innovative monetary frameworks that help in identifying the real market price of a firm. Give consultatory operate in relationship to company evaluation to aid in bargaining and pricing structures. Clarify the most ideal form of the offer and the sort of consideration to utilize (cash money, stock, make out, and others).

Develop action prepare for threat and exposure that have been recognized. Perform combination preparation to determine the process, system, and business changes that may be needed after the bargain. Make mathematical estimates of combination prices and advantages to assess the economic reasoning of assimilation. Establish guidelines for integrating departments, innovations, and organization procedures.

Recognize possible decreases by reducing DPO, DIO, and DSO. Evaluate the prospective client base, market verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance offers important insights into the performance of the company to be gotten concerning risk analysis and value development. Determine short-term adjustments to finances, banks, and systems.